AsheMorgan is built on over 130 years of the founders’ individual talent and 40 years of seamless collaboration.

Senior Management & Board

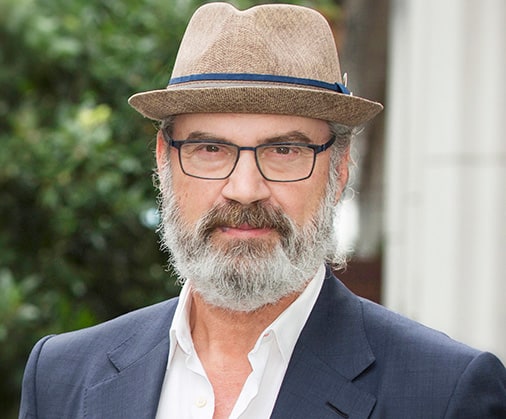

Michael Moss

MoreMichael began his career as an accountant and had experience in real estate investment prior to establishing AsheMorgan in 1981.

Michael is responsible for group strategy and chairs the Investment Committee. He is also responsible for strategic management of The District Docklands.

Michael’s experience over numerous property cycles has emphasised the importance of managing risk, which continues to be a key focus in investment assessment and management for the group. AsheMorgan’s track record of enhanced risk adjusted returns are achieved through considered execution strategies supported by appropriate capital management and prudent financial leverage.

Michael holds a Bachelor of Commerce from the University of NSW and currently chairs the Kesser Torah College (“KTC”) Foundation.

Michael Rothner

MoreMichael joined AsheMorgan in 1990 and leads investor relations, funds management and joint ventures for the group, with a focus on achieving enhanced risk adjusted returns via insightful and disciplined strategies.

Michael is an Investment and Compliance Committee member. Michael has substantial experience in development and construction as well as asset and investment management. Michael has been instrumental in expanding AsheMorgan’s business and partnerships both domestically and internationally.

Michael holds a Bachelor of Commerce Degree from the University of NSW, completed a Harvard Business School of Management leadership course and is a fellow member of the Australian Property Institute.

Alton Abrahams

MoreAlton joined AsheMorgan in 1995 and leads the group in direct property investment and development covering, commercial office, retail and large-scale mixed-use projects.

As the Head of the Asset Management Team, Alton is focused on the identification, sourcing and negotiation of real estate investment opportunities, leveraging off his wide-ranging experience in investment and development.

Alton co-ordinates the extensive real estate due diligence process undertaken prior to any acquisition and is integral in determining and implementing the investment’s objectives and strategies to maximise underlying real estate potential.

As a member of the Investment Committee, Alton is highly involved in all aspects of asset management, from settlement right through to the sale / realisation of any investment at an optimal juncture in the real estate market cycle.

Mendy Moss

MoreMendy joined AsheMorgan in 2003 and focuses on private and institutional investor relationships, debt relationships as well as capital transactions.

Since the groups focus on principal investment from 2010, Mendy has maintained and expanded strong relationships with diverse sources of debt and equity capital. Mendy retains a close alignment with leading property market participants including Australian and Offshore Limited Partners (LPs) and General Partners (GPs), investment banking teams, commercial agents and advisors and valuers.

As an Investment Committee member, Mendy has refined his expertise in structured debt and equity raising for investment and development assets, providing capital and structuring solutions across the AsheMorgan portfolio.

Hans Borgelt

MoreHans joined AsheMorgan in 2006 and is responsible for all Group financial matters including cash flow, profitability forecasts and financial planning. Hans also serves as the Company Secretary and is a member of the Investment and Compliance Committee.

Hans is highly experienced in finance, including financial and product control, project-based system implementations, as well as structured transactions including complex debt finance structures involving arbitrage opportunities.

Hans has extensive international experience, having worked for Barclays Capital, Credit Suisse First Boston and the Royal Bank of Scotland.

Hans holds a Bachelor of Commerce Degree from the University of Cape Town and a Post Graduate Diploma in Accounting from the University of South Africa. Hans is a member of the South African Institute of Chartered Accountants and the Australian Institute of Company Directors.

James Groom

MoreJames has been an external legal adviser to AsheMorgan since 2002, and a Non-Executive Director and Company Secretary since 2007. James is the chair of the Compliance Committee.

James’ legal career began in the early 1990s and included roles with leading corporate law firms in Australia, the U.K. and the U.S.A., as well as a position as senior corporate counsel at GE Capital. In 2001 James established Groom Kennedy, a law firm with clients across Australia.

James specialises in corporate and financial services law and serves on several private company Boards and on the Council of the University of Tasmania. James has a Bachelor of Arts Degree and a Bachelor of Law from the University of Tasmania.

Asset Management

Scott Miles

Darrell Prasad

Sam Johnston

Christopher Oh

Bethany Irwin

Jade Scott-Holland

Richard Bartlett

Jamie O’Reilly

Tessa Condor

Michael Johns

George Karabatsos

Development Management

Andrew Whiteside

Mat Stoddart

Capital Transactions & Markets

Dinesh Kapoor

Robert Schmidt

Edward Madden

Romy Staude Brown

Finance & Administration

Wilson Justo

Lara Garcia

Lilian Chau

Gejie Magsipoc

Gaurav Gundigara

Christinne Panganiban

Isabella Groves

“This is a significant, asset-focused team with a shared vision, accumulated knowledge and specialised, complementary skillsets.”

MICHAEL MOSS